Real Financial Planning That Actually Works

We're not your typical financial advisors. Since 2019, we've helped Australian families navigate the ups and downs of seasonal income, unexpected expenses, and those big life moments that catch everyone off guard.

How We Started This Journey

Back in 2019, I was sitting in a coffee shop in Parramatta when a friend mentioned she had no idea how to save for her kids' school fees while managing irregular freelance income. That conversation changed everything.

Traditional financial advice wasn't cutting it for real Australian families. The cookie-cutter approaches ignored seasonal work patterns, school holiday expenses, and the reality of living paycheck to paycheck even with decent incomes.

We realized families needed financial strategies that actually fit their messy, real-world situations. Not theoretical portfolios, but practical systems for managing money when life gets complicated.

What Makes Us Different

We focus on seasonal financial planning because Australian families have seasonal lives. School fees hit twice a year. Christmas happens every December. Holiday expenses are predictable, but most people still get caught off guard.

Our approach combines traditional financial planning with practical money management for families dealing with irregular income, seasonal expenses, and the unique challenges of Australian family life.

Our Three-Step Approach

We've refined our process over six years of working with Australian families. Here's how we help you build financial security that actually works.

Map Your Real Spending

We dig into your actual spending patterns - including those "invisible" seasonal expenses that derail most budgets. School uniforms, car registration, holiday gifts - we factor in everything.

Build Buffer Systems

Instead of generic emergency funds, we create targeted savings systems for your specific seasonal needs. Different buckets for different expenses, all automated and stress-free.

Adjust and Optimize

Life changes, and your financial plan should change with it. We review and adjust your systems quarterly to keep everything working smoothly as your family grows.

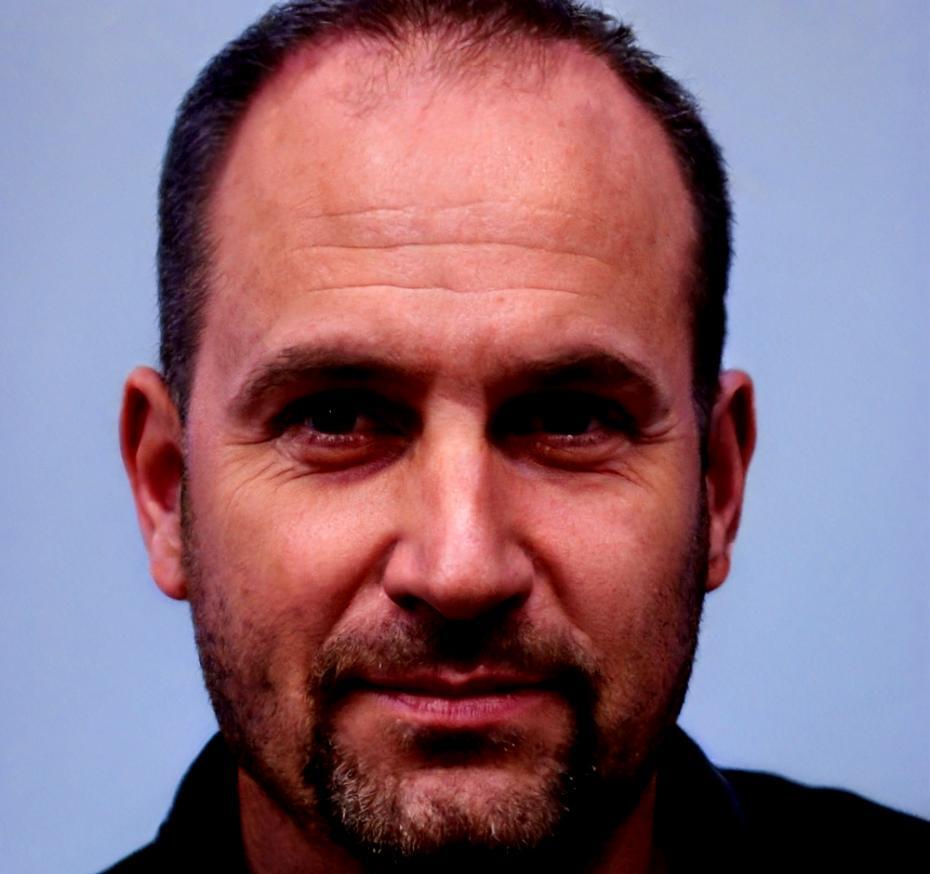

Meet the People Behind kiferalithon

We're a small team of financial planners, former teachers, and parents who understand the real challenges Australian families face. No suits, no jargon - just practical help from people who get it.

Marcus Chen

Former high school teacher who switched to financial planning after seeing too many families struggle with money stress. Specializes in seasonal budgeting for families with irregular incomes.

Riley Thompson

Mother of three who brings real-world parenting experience to financial planning. Expert in education savings strategies and managing the chaos of family finances.

What We Believe About Money

Financial Plans Should Fit Real Life

Your money management system should work with your actual life, not some idealized version. Irregular income, unexpected expenses, and changing priorities are normal - your financial plan should handle all of that.

Small Changes Create Big Results

You don't need to completely overhaul your lifestyle to build financial security. Small, consistent changes that fit your family's routine create lasting results without the stress.

Education Beats Quick Fixes

We'd rather teach you to understand your money than manage it for you. When you understand why we recommend certain strategies, you can make confident decisions on your own.

Honesty Over Sales Pitches

Sometimes the best advice is to do nothing. We'll tell you when you don't need our help and when a simple DIY approach might work better than complex financial products.